Current bond price formula

As mentioned above the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price. Coupon Rate 6.

How To Calculate Pv Of A Different Bond Type With Excel

For each bond the current yield is equal to the annual coupon divided by the bonds face value FV.

. P - Bond price when interest rate is incremented. The Formula used for the calculation of Price of the corporate bond is. Ad See how Invesco QQQ ETF can fit into your portfolio.

Bond yield is also referred to. Rate Divide by payouts a year Number of Periods Payouts per year multiplied by years Payment Annual payment divided by payouts per year Future Value. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

Yield is inversely proportional to the bond price. Find the bond yield if the bond price is 1600. Ad See how Invesco QQQ ETF can fit into your portfolio.

P Bond price when interest rate is decremented. The market interest rate is 10. And the interest promised to pay coupon rated is 6.

To get the current market value bond price you use a. Company A has issued a bond having face value of 100000 carrying annual coupon rate of 8 and maturing in 10 years. Calculate the bond price.

P 0 Δy 2. Δy change in interest rate in decimal form. Face Value 1300.

Regardless of the bond price the coupon always stays the same. Bond price 10363484 Considering that the bond price is higher than the par value the bond should be selling at a premium. The price of the.

The current market price of bonds is the present value of all future cash flows discounted by a suitable interest rate. P P - - 2P 0. PRICEC4C5C6C7C8C9C10 The PRICE function returns the value.

The formula for calculating the value of a bond V is. 30 x 1 1 004-18 Bond Price 004 1000 x 1 004 -18 And the result is a Bond Price 8734 Youll notice that the calculated Bond Price is lower than the Bonds Face. Suppose a bond has a face value of 1300.

The PV formula works like this. Current yield annual interestbond price100. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

What is a bond. Discount Bond 60 950 632 Par Bond 60 1000 600 Premium Bond. I annual interest payable on the bond.

Ad Use Our Simple Tools To Create Your Bond Strategy. P 0 Bond price. F Par value of the bond repayable at maturity r discount factor or required.

Current Yield of a Bond Formula Current Yield of Bond Formula Annual Coupon Payment Current Market Price You are free to use this image on your website templates etc Please.

Bond Pricing Formula How To Calculate Bond Price Examples

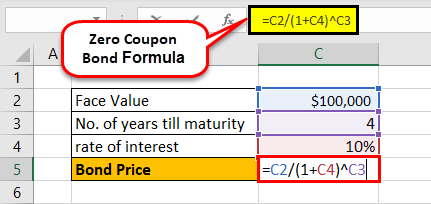

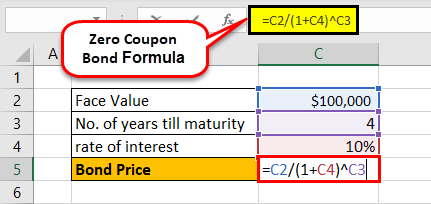

Zero Coupon Bond Formula And Calculator

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Bond Price In Excel

Bond Pricing Formula How To Calculate Bond Price Examples

Excel Formula Bond Valuation Example Exceljet

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Price Formula Excelchat Excelchat

Bond Yield Calculator

How To Calculate The Current Price Of A Bond Youtube

Bond Pricing Formula How To Calculate Bond Price Examples

An Introduction To Bonds Bond Valuation Bond Pricing

How To Calculate Present Value Of A Bond

Bond Pricing Formula How To Calculate Bond Price Examples

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Yield To Call Ytc Bond Formula And Calculator